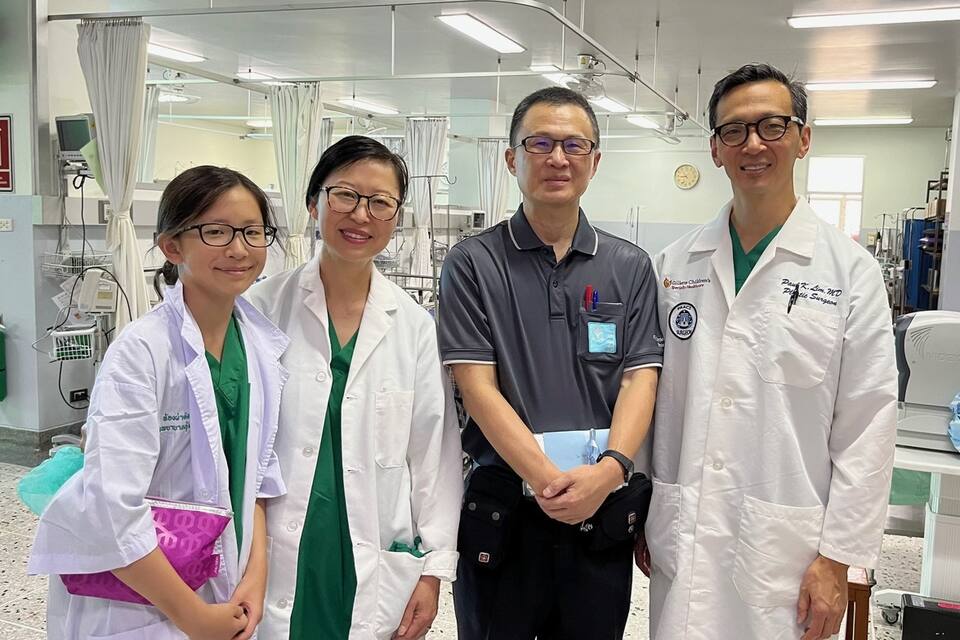

Drs. Paul and Susan Lim, Korean-American physicians, are living in Chiang Mai, Thailand, studying the Thai language full time in order to gain enough fluency to serve at their target ministry location, a remote village at the western Thai-Burmese border where there are no English speakers and no schools for learning Thai as a second language.

The ethnically Thai people group is <2% Christian (>98% Buddhist). In their target region, there are no Thai Christians, no Thai church, and no missionaries living there yet—Drs. Lim hope to change all that.

They have been enthusiastically invited to work as volunteers at the local government hospital by the director, a physician and Buddhist monk, because of the specialty medical care which they can provide and which is unavailable in the region. Paul is a pediatric plastic surgeon with particular expertise in cleft lip and palate surgery, and Susan is a pediatrician with substantial experience in the care of children with disabilities especially cleft lip and palate.

They moved to Thailand in September 2024 and anticipate three to four years of language study before fully moving to the village not only to be able to competently share the Gospel in Thai but if, Lord willing, there is a new believer, to be fluent enough in Thai to disciple them by teaching them to observe all that Jesus commanded (Matthew 28:18-20).

In the meantime, the plan is to do week long surgical trips to the village in increasing frequency as their language skills improve and their need to bring bilingual translators to the village decreases.

Prior to moving to Thailand, they lived and served for five years in Egypt in a rural town in the Nile Delta region. Their first deployment as full-time missionaries was to Ethiopia where they served for three years.

They have three children: Justin and Karis who are in college in the US and Madeleine who is in 6th grade in Chiang Mai

For all funds sent to this account, only US Credit Card holders and Paypal users will be able to receive US Tax Documents. All other funds are qualified for Korean Tax Documents only. Funds sent in South Korean Won cannot be applied to US Tax Documents.

All USD funds will be sent via Footstool Mission Center.